- BeanWealth

- Posts

- The Quiet Backbone Of AI

The Quiet Backbone Of AI

Copper Is The New Gold Rush

BREAKING: Kodiak Copper has dropped BREAKING news. Please read it here.

The Copper Story Entering a New Era

Copper is suddenly at the center of one of the biggest shifts in the modern economy. Not because of electric vehicles. Not because of solar panels. Those stories have been around for years. The real driver now is artificial intelligence.

Tech companies are racing to build energy hungry data centers at a speed that very few people predicted. These facilities require enormous electrical systems, long runs of industrial scale wiring, heavy power infrastructure, and enough cooling and substation capacity to power small cities. Copper is behind every part of that buildout.

As demand tightens, the market is beginning to look at projects that can step into the next cycle of supply. That is where exploration stage companies sometimes separate themselves. They spend years drilling, sampling, and mapping until one moment changes the entire trajectory. The moment when the work on paper becomes a defined resource and the market starts seeing a clearer picture.

Kodiak Copper (OTCQX: KDKCF) is entering that moment right now.

The company has spent years assembling control of a large land package in a producing porphyry belt in British Columbia. Their share price performance throughout the year has already shown that more eyes are turning toward the story. But the catalyst that really shifted sentiment was their first NI 43 101 compliant Mineral Resource Estimate delivered in 2025. That was the point where MPD began transitioning from an exploration concept into a project with defined potential.

This upcoming period is important. Kodiak Copper (OTCQX: KDKCF) has additional zones moving toward inclusion in a future resource update. Early work suggests the footprint could be larger than originally understood. None of that guarantees any specific outcome, but it does show measurable progress in a district known for long life copper mines.

The MPD Project and Why It Stands Out

The MPD project sits in one of the most established copper regions in Canada. It covers roughly 357 square kilometres positioned between two well known operations. Hudbay’s Copper Mountain Mine and Teck’s Highland Valley Copper both operate in the same geological setting. These are real producing mines, and both have expansion plans under way.

Before Kodiak Copper (OTCQX: KDKCF) consolidated the land, MPD was fractured across different owners and had never been explored as a unified copper system. That changes the approach entirely. Porphyry deposits do not form neatly in one spot. They tend to appear in clusters. When you can test multiple zones on one contiguous property, the odds of understanding the full system improve significantly.

Kodiak Copper (OTCQX: KDKCF) has already identified seven mineralized zones, and four of those were included in the 2025 resource estimate. The result moved the project from early stage exploration into resource building. The next step is an updated resource estimate that could incorporate three additional zones. Each new model brings more clarity. Every added tonnage provides more scale. And most of the property remains open with roughly twenty targets that have not seen modern drilling.

That is the type of environment where meaningful discoveries can still happen.

The Copper Backdrop Is Tightening

Copper has been in a multi year discussion around electrification, but 2025 introduced something new. Artificial intelligence is no longer a concept. It is an infrastructure buildout that stretches across the entire power grid. Data centers require massive electrical systems, and copper is central to those systems.

Recent studies show that data centers in the United States could consume between 6.7 percent and 12 percent of all domestic electricity by 2028. That is a dramatic shift from current levels. As this buildout accelerates, copper becomes one of the most strategically important materials for grid capacity, substation design, transmission lines, and power distribution.

On the supply side, the picture has been tightening. Grades at existing mines continue to fall. New projects face longer permitting timelines. And global spending on greenfield copper mines has not kept pace with rising demand. Analysts across the industry have noted a growing deficit through the second half of the decade. Several major banks have increased their copper price forecasts into 2026 and beyond.

This is the type of macro environment where large scale copper systems in stable jurisdictions begin attracting more attention.

The Jurisdiction Advantage

British Columbia has become a focus point for Canadian critical mineral development. The province has significant infrastructure, road access, a trained mining workforce, and the type of political framework that supports major projects. In 2025, BC announced a fast track path for select mining and energy projects representing approximately twenty billion dollars of potential investment.

MPD sits directly within that corridor. It is accessible by road, close to power infrastructure, and surrounded by producing mines. Large mining companies frequently prioritize areas where permitting frameworks, communities, and infrastructure are already aligned with mining activity. MPD checks those boxes.

Why This Story Is Starting to Build Momentum

A few elements are coming together at the same time.

Kodiak Copper (OTCQX: KDKCF) now controls a district scale land position in a proven copper belt. Their first resource estimate provided a baseline for the project. Additional zones are already being prepared for inclusion in the next update. And the property remains open with multiple untested targets that could extend the mineralized footprint.

The company also has a strong treasury. With roughly eighty eight million dollars available, Kodiak Copper (OTCQX: KDKCF) has the ability to keep drilling and expanding the project while many exploration companies scale back due to market constraints. In exploration, consistent drilling is often what separates projects that grow from projects that stall.

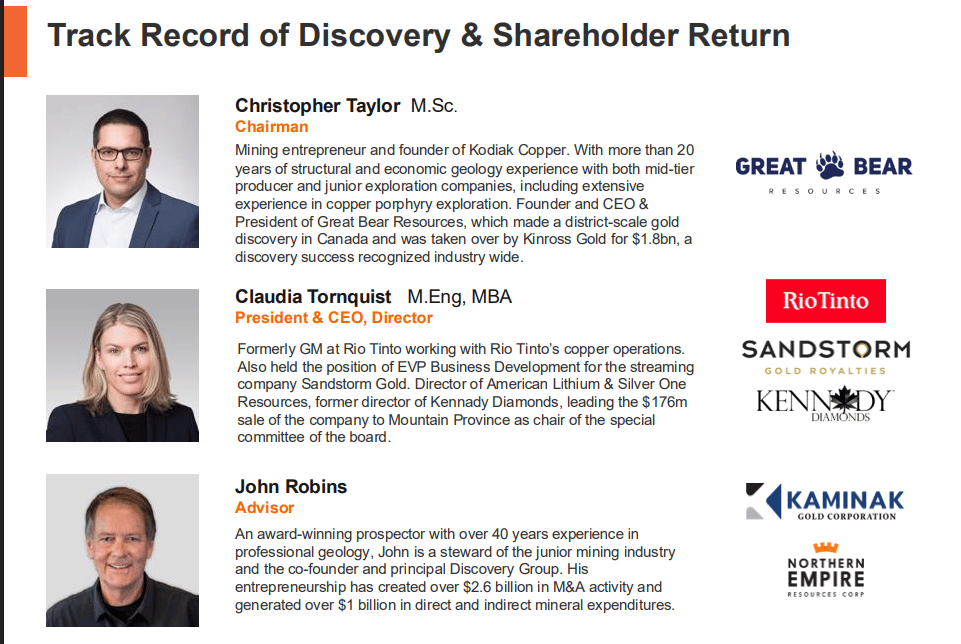

Another factor is leadership. Kodiak Copper (OTCQX: KDKCF) is part of the Discovery Group, a network known for advancing exploration stories that eventually attracted major industry transactions. Their track record does not guarantee anything, but it does bring experience in navigating complex geological systems.

Taken together, these pieces give the MPD project a combination of scale potential, upcoming catalysts, and financial capability that is becoming more visible across the mining sector.

Looking Ahead

The most likely catalyst on the horizon is the next Mineral Resource Estimate. Including three additional zones would help define how large this system might be. The timing aligns with a broader copper market that is tightening due to rising data center power demands and falling supply growth from existing mines.

MPD is still early in its life cycle. It is not a development project today. It is not a producing mine. But it is no longer a pure early stage concept either. It is in the stage where drill data, resource models, and zone expansion begin forming the outline of what the project could become.

The Bottom Line

Kodiak Copper (OTCQX: KDKCF) is moving through an important transition. Years of consolidation and exploration work are now being translated into formal resource estimates. More zones are advancing toward inclusion. The property covers a large, underexplored district between two well known producing mines. And the copper market is evolving quickly as AI infrastructure ramps up global electrical demand.

None of this guarantees any specific outcome. Exploration is inherently uncertain, and resource growth takes time. But the combination of scale, jurisdiction, capital, and upcoming catalysts explains why more people are watching the MPD story as it develops.

Disclosure of Compensation

“The Influencer” and its officers, directors, owners, managers, affiliates, and control persons (collectively referred to as the “Publisher”) have been compensated ($1,600 USD) by a third party to publish favorable information (the “Information”) about Kodiak Copper.

The Information shared by the Publisher is an advertisement.

Because the Publisher has received compensation to distribute this Information, securities laws including Section 10(b) of the Securities Exchange Act of 1934, Rule 10b 5, and Section 17(b) of the Securities Act of 1933 require disclosure of the nature and amount of such compensation.

The Paying Party and its affiliates may buy or sell securities of the Issuer before, during, or after the publication of this Information. This may result in profits due to price fluctuations influenced by the dissemination of this content.

Forward-Looking Statements

Certain information provided in this communication may contain “forward-looking statements,” which include “future-oriented financial information” and “financial outlook” under applicable securities laws. These statements are based on management’s current beliefs and expectations regarding business operations, financial performance, strategic plans, and market conditions.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that could cause actual results to differ materially from projections. Investors should not place undue reliance on these statements. Factors beyond the Company’s control may affect outcomes.

The Publisher does not undertake any obligation to update or revise forward-looking statements unless required by applicable securities laws. Readers are strongly advised to perform their own due diligence and consult a licensed financial advisor before making investment decisions.

Disclaimer for BeanWealth

BeanWealth is a publisher of financial education and information. We are not an investment advisor and do not provide personalized financial advice or recommendations. All content is for educational and informational purposes only.

Information is provided “as is,” without warranty of any kind. BeanWealth makes no representations or guarantees regarding accuracy, completeness, or timeliness. Opinions expressed are those of the author and do not necessarily reflect the views of BeanWealth, its partners, or affiliates.

Investors should conduct independent due diligence before making any investment decisions. None of the information provided constitutes a solicitation to buy or sell any securities.

BeanWealth, its employees, and affiliates may hold positions (long or short) in the securities mentioned, and these positions may change without notice.

Forward-looking statements, estimates, or forecasts are inherently uncertain and based on assumptions that may not occur. BeanWealth assumes no obligation to update or correct information after the publication date and disclaims liability for any loss or damage arising from its use.

Unauthorized reproduction or distribution of this content is strictly prohibited and may result in legal action.