- BeanWealth

- Posts

- The Credit Card Collapse Has Started

The Credit Card Collapse Has Started

Credit stress is building fast...

This installment of BeanWealth is free for everyone. If you want to grow your portfolio with one high-upside stock idea every week—including two hand-picked by Matt Allen and two based on what billionaire investors and members of Congress are buying, with clear, easy-to-follow breakdowns that show you why it matters:

Good Evening! 👋

Welcome to Sunday’s Bean Breakdown. Credit card defaults are rising, savings are gone, and banks are quietly preparing for what comes next.

HEADLINES

What You Need To Know

President Trump announced a new trade deal with the European Union that will impose a 15% tariff on most EU exports to the U.S., including automobiles. In return, European countries will gain zero-tariff access to the American market for a range of goods, and the EU has committed to major U.S. investments, including $750 billion in energy and $600 billion in direct spending. The agreement was finalized just days before steeper tariffs were set to take effect and was praised by European leaders as a step toward economic stability. Trump said the pact also includes large-scale military purchases from the U.S., while both sides noted further negotiations are underway on steel, aluminum, and other sectors.

Tesla reported a second straight quarterly drop in vehicle sales and a 16% decline in auto revenue, missing Wall Street estimates. CEO Elon Musk warned of “a few rough quarters” ahead, citing expiring EV tax credits and new tariff-related supply chain disruptions. Revenue came in at $22.5 billion, short of expectations, with net income falling to $1.17 billion. Tesla deliveries dropped 14% to 384,000 vehicles, and sales of regulatory credits nearly halved. The company also began limited production of a more affordable EV and expanded its robotaxi pilot in Austin, though Musk admitted broader rollout depends on regulatory approval.

Senior U.S. and Chinese negotiators met in Stockholm on Monday to try and extend a fragile truce before tariffs between the two nations snap back to levels above 100%. The talks, led by Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng, come just ahead of the August 12 deadline set by President Trump’s administration. While few expect a breakthrough, the meeting could help prevent further escalation and set the stage for a potential Trump-Xi summit later this year. China is pushing for lower tariffs and looser tech export restrictions, while U.S. officials want structural reforms and more domestic demand from China.

Amazon confirmed that it’s laying off employees in its cloud division, Amazon Web Services, as part of an internal reorganization. While the company didn’t specify how many people were affected, it said the cuts are focused on certain teams, including the AWS training and certification unit. The layoffs follow a third straight revenue miss for AWS, which posted $29.27 billion in Q1 sales, up 17% but slower than the prior quarter. Amazon said the cuts aren’t tied to its AI investments, but rather part of broader efforts to streamline operations and refocus priorities. CEO Andy Jassy has been trimming costs since 2022, resulting in over 27,000 job cuts. While the pace has slowed, layoffs continue across different business units. The company says it’s still hiring in key areas of AWS despite the recent reductions.

President Trump is keeping the pressure on Federal Reserve Chairman Jerome Powell, branding him “Too Late” and recently asking House Republicans if he should fire him. While Trump has since said it is “highly unlikely” he would remove Powell, unless there is fraud involved, the legal authority to do so remains unclear. Instead, the Trump administration has turned its attention to the Fed’s $3.1 billion renovation project. Budget chief Russ Vought called it “grossly mismanaged” and questioned the scale of the construction. Treasury Secretary Scott Bessent, who is seen as a possible successor to Powell, said this week that the central bank needs a full review. Trump’s visit to the Fed marked just the fourth by a sitting president since 1937, when President Franklin D. Roosevelt dedicated the building. No previous visit took place while the president was publicly pushing for changes to monetary policy or threatening to investigate the Fed chair

PREMIUM RESEARCH

The Everyday Investor Club

If you want to grow your portfolio with one high-upside stock idea every week—including two hand-picked by Matt Allen and two based on what billionaire investors and members of Congress are buying, with clear, easy-to-follow breakdowns that show you why it matters:

OPINION

Matt Allen’s Take

Source: @bean_wealth

It’s not 2008. But it’s not nothing.

Credit card delinquencies are rising. Defaults are climbing. And major banks are quietly preparing for more. If you’ve been wondering where the cracks in the economy might show up first, this is it. We’re not facing a collapse, but we are watching a slow-moving credit crisis take shape in real time.

Let me explain what’s happening, what the numbers say, and why this matters for investors.

The Worst in Over a Decade

Here’s the reality. Credit card charge-offs hit 4.44% in January 2025, the highest level since 2011. Since then, we’ve seen a slight improvement. Charge-offs dipped to 4.29% in the first quarter. But that doesn’t change the overall picture. The pressure is building.

Delinquencies on accounts that are 90 days past due climbed to 12.3% in Q1. That’s up 8.5% from the previous quarter. And credit card balances just hit a record $1.18 trillion.

This is the steepest deterioration we’ve seen since the post-2008 recovery. It’s not just a data blip. It’s widespread and persistent.

Who’s Feeling It?

The pressure isn’t spread equally. It’s hitting middle-income families the hardest, especially those between the ages of 30 and 49. These are prime working years. People are raising kids, paying mortgages, and carrying the economy. And now they’re falling behind.

In the poorest ZIP codes, nearly 18% of cardholders are delinquent. In wealthier areas, that number is closer to 6%. The gap is growing.

During the pandemic, people had a cushion. Stimulus checks. Loan forbearance. Fewer expenses. That’s gone. Inflation has squeezed that margin, and now more households are putting rent, gas, and groceries on credit cards. Not travel or gadgets. Just the basics.

The Interest Rate Trap

The average credit card APR in July 2025 was 20.13%. That’s just slightly below last year’s record high. But here’s the problem. The interest margins are widening. Banks are charging more above the prime rate than ever before. Even borrowers with good credit are paying more than they used to.

This creates what I call the quicksand effect. You carry a balance, and it gets harder and harder to climb out. Minimum payments don’t move the needle. Interest keeps piling up. Eventually, people give up.

It’s Not Just Credit Cards

Student loan payments restarted in May. That was another hit to household budgets. Over 5.6 million borrowers are already delinquent. One-third of them are over 90 days past due. That’s hurting credit scores across the board.

More than two million people have lost 100 points on their credit score. Another million have lost 150 or more. That affects everything from housing to car loans to job applications.

Then there’s Buy Now, Pay Later. It took off during the pandemic as a way to delay payments without interest. But the cracks are showing. Forty-one percent of BNPL users missed a payment in the past year. That’s not a safety valve anymore. That’s just more debt.

Banks Are Bracing

The banks see what’s happening. And they’re not waiting to act.

They’re lowering credit limits. Tightening standards. And building reserves for future losses. Just in Q2:

JPMorgan reported $2.4 billion in net charge-offs

Citi reported $2.2 billion

Wells Fargo charged off almost $1 billion

Smaller banks are under even more pressure. Outside the top 100, delinquency rates are already above 7%. These institutions don’t have the same capital cushion. If things get worse, they’re going to feel it first.

Even the Federal Reserve’s stress test modeled nearly $158 billion in credit card losses. That tells you how serious this is.

What Happens Next

This isn’t an immediate crash. The job market is still holding up. Spending is still positive. But things are cooling fast.

Credit is tightening. Spending is slowing. And the most vulnerable households are already feeling the squeeze. This is the kind of slow-motion stress that doesn’t break the economy overnight. But it chips away at it.

Missed payments lead to lower credit scores. That leads to less borrowing and weaker consumer demand. And in a country where 70% of GDP comes from consumption, that matters.

My Take

This isn’t panic territory. But it is time to pay attention.

If you’re investing in consumer-facing sectors like retail, autos, or financials, you need to understand what’s happening underneath. We’re seeing the most severe consumer credit stress since the Great Recession. And for the first time in a long time, it’s not just hitting the poor. It’s hitting the middle.

The consumer isn’t broken. But they’re showing signs of real fatigue. And if that spreads, the rest of the economy won’t be far behind.

Every Thursday, I send premium members one high-conviction stock idea. I send them two high conviction stocks from myself plus two stocks tracked from billionaire investors and members of Congress—so you know what they’re buying and why they’re betting big.

UPCOMING

What You Need To Watch

On Tuesday, the Conference Board releases its Consumer Confidence data. Confidence has been holding up better than expected, but I’ll be watching expectations for future income and jobs.

On Tuesday, we also get June JOLTs data. Job openings have been trending lower, and continuing claims are at a multi-year high. I’ll be looking at the quits rate. If workers are less willing to leave jobs, it usually means the labor market is losing momentum.

On Wednesday, Q2 GDP data is released. Growth surprised to the upside last quarter, but with tighter credit and slower hiring, I’m watching to see if that strength held. A weaker print could give the Fed more cover to consider cuts later this year.

On Wednesday, the Fed announces its latest interest rate decision. No one expects a move, but the tone of the press conference and the updated economic projections will be critical. With core PCE still at 2.7 percent, I’ll be focused on how many cuts the Fed is still signaling for 2025.

On Thursday, June PCE inflation data drops. This is the Fed’s preferred measure, and core PCE has been stuck above 2.5 percent all year. If we finally see it cooling, the case for a September or November cut gets stronger. If not, the market may need to reprice.

On Friday, the July jobs report is released. The forecast is around 115,000 jobs added, with unemployment holding near 4.3 percent. But the real story is in wage growth and revisions. If wages stay hot or May gets revised higher, that could keep the Fed cautious into the fall.

TIP

Why I Care About a Company’s Customer Retention

Customer retention tells me more about a business than almost any other metric. If a company can keep its customers coming back, it usually means the product delivers real value and the business has pricing power, loyalty, or both.

I look for high retention rates in subscription-based models, but it matters across the board. Whether it’s a software company, a gym, or even a consumer brand, strong retention often leads to predictable revenue and lower customer acquisition costs.

If a company is constantly losing customers, it has to work twice as hard just to stay flat. I prefer businesses that build lasting relationships.

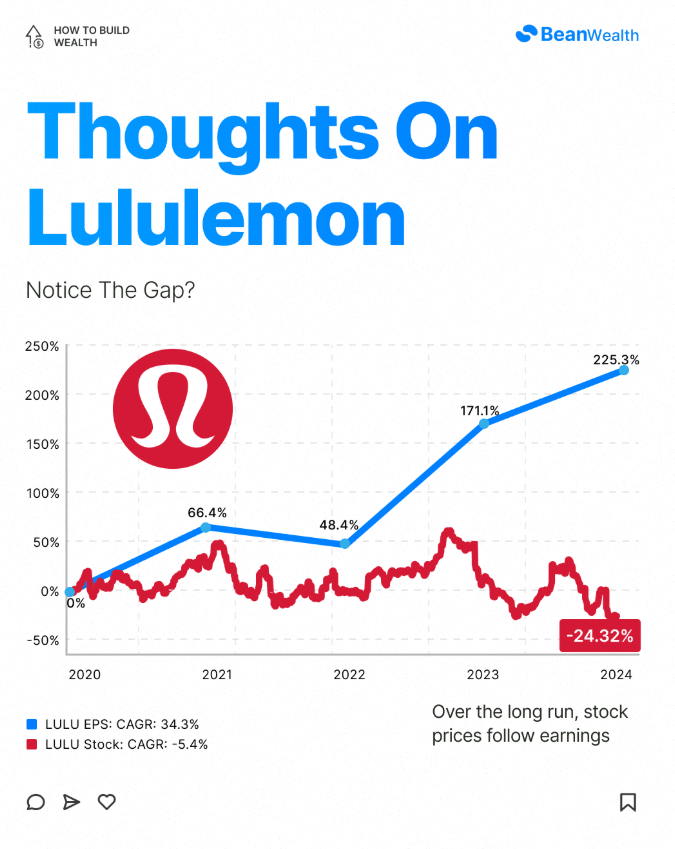

CHART

Lululemon

Source: @bean_wealth

TERM

Run Rate

Run rate takes a company’s current performance and projects it over a full year. I use it to get a rough sense of future revenue, especially when looking at high-growth companies that don’t have a full year of data yet.

For example, if a company brings in $25 million this quarter, its run rate is $100 million. That assumes the next three quarters will look similar, which isn’t always the case.

It’s a helpful shortcut, but I never rely on it alone. I always ask whether that pace is sustainable or just a temporary spike. Context matters.

See you on Wednesday!

Cheers,

Matt Allen

Disclaimer:

This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. BeanWealth is not a registered investment adviser, broker-dealer, or financial planner. You should not construe any material in this newsletter or related social media posts as a recommendation, solicitation, or offer to buy or sell any securities.

On July 7, 2025, BeanWealth received $1,900 from Vistagen (Nasdaq: VTGN) to publish a sponsored feature in our newsletter and related posts on our social media platforms. This is a paid marketing communication. The views expressed are our own and do not reflect the views of Vistagen or its management.

Investing in stocks involves risk, including the potential loss of principal. Always do your own research and consult with a licensed financial professional before making any investment decisions.

BeanWealth and its affiliates make no representations or warranties about the accuracy or completeness of any forward-looking statements or projections discussed.

Disclaimer for BeanWealth

BeanWealth is a publisher of financial education and information. We are not an investment advisor and do not provide personalized investment advice or recommendations tailored to any individual's financial situation. The content provided through our website, newsletters, and any other materials is for educational purposes only and should not be construed as financial or investment advice.

All information is provided “as is,” without warranty of any kind. BeanWealth makes no representations or guarantees regarding the accuracy, completeness, or timeliness of the information presented. The opinions and views expressed in our content are those of the author(s) and do not necessarily reflect the views of BeanWealth, its partners, or its affiliates.

Investors should perform their own due diligence and consult with a professional financial advisor before making any investment decisions. None of the information provided herein constitutes a solicitation to buy or sell any securities or financial instruments. Any projections or forecasts mentioned are speculative and subject to risks and uncertainties that could cause actual outcomes to differ.

BeanWealth, its employees, and affiliates may hold positions (long or short) in the securities or companies mentioned, and these positions may change without notice. No guarantees are made regarding the continuation of these positions.

Forward-looking statements, estimates, or forecasts provided are inherently uncertain and based on assumptions that may not occur. Other unforeseen factors may arise that could materially affect the actual outcomes or performance of the securities discussed. BeanWealth has no obligation to update or correct any information after the date of publication.

BeanWealth disclaims any liability for losses or damages, whether direct or indirect, resulting from the use of the information provided. By accessing or using any BeanWealth content, you agree to this disclaimer and our terms of service.

Unauthorized distribution, reproduction, or sharing of this content is strictly prohibited and subject to legal action.