- BeanWealth

- Posts

- Small-Cap Building Global Infrastructure

Small-Cap Building Global Infrastructure

SaaS Company...

Good Morning! 👋

This newsletter is sponsored on behalf of Turnium Technology Group and not financial advice.

Hey there,

Turnium Technology Group (TSXV: TTGI): The Small-Cap SaaS Company Quietly Building a Global Infrastructure Business

Every now and then, a small company quietly shifts gears, and if you’re watching closely, you catch it before the rest of the market does.

That’s what’s happening right now with Turnium Technology Group. They’re based in Vancouver and trade on the TSX Venture Exchange under the symbol TTGI. But this isn’t just another Canadian tech company.

They’ve built something most investors haven’t really noticed yet. A global, recurring revenue business with real clients, strong gross margins, and accelerating momentum.

And the entire story changed when they bought a company called Claratti.

Let’s break it down.

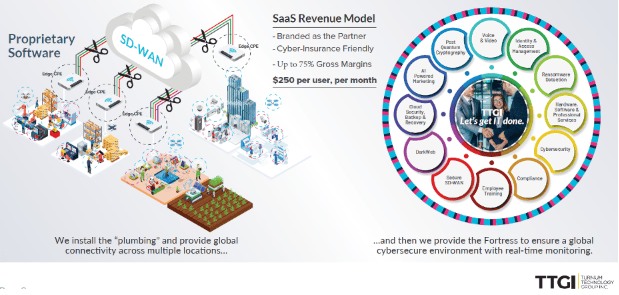

A Business Model Built for Scale

Turnium’s main business is about helping companies stay connected. At its core, they provide secure, reliable internet connections for businesses that operate across multiple locations.

But they don’t just sell internet service.

Turnium has developed a wholesale “utility-service-style” approach to supplying the multi-billion-dollar SME market with a whole-of-business Technology as a Service (TaaS) model. Think of Turnium’s technology as being as simple to acquire as turning on a switch to get lights or lifting a tap to get water. Turnium has reinvented and simplified how SME companies can adopt and implement technology across their entire business, improving connectivity to the Internet and safeguarding their business against Cybersecurity.

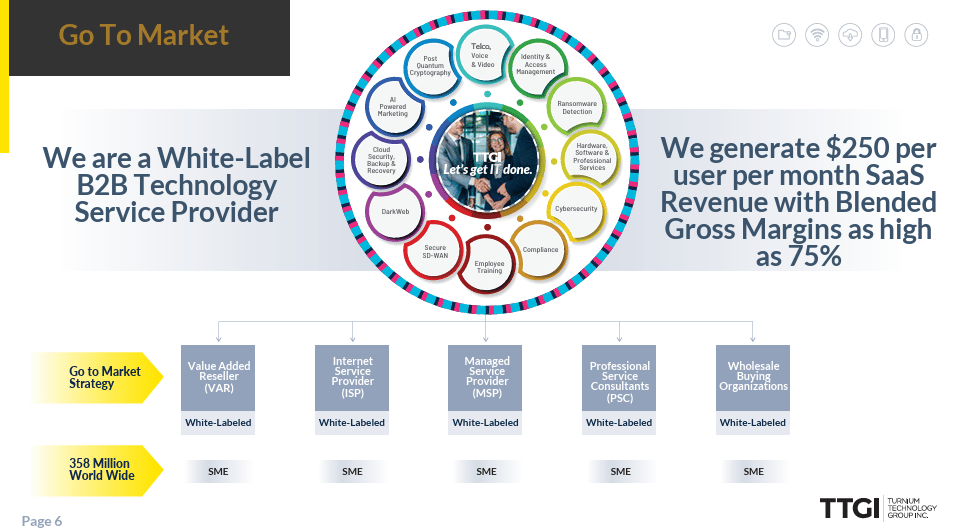

What makes Turnium’s model hyperscalable is that the TaaS solution has been designed to sell to the end customers via their 70 worldwide partner network. Channel partners love it as they can rebrand the solution and resell it as part of their tech stack to their small and mid-sized businesses.

With over 70 partners across four continents, combined with the recent acquisition of Claratti in Australia, Turnium have transformed from a product-only business into a technology-based solutions business.

Turnium’s platform is enterprise-grade and includes all the necessary components, from managed services and cybersecurity to post-quantum encryption and edge AI-based sales capabilities. It’s built to support the next generation of internet infrastructure for businesses.

Even if one part of the network goes offline, the rest continues to work without disruption.

Now imagine you’re a local IT services company working with dozens of small businesses. With Turnium, you can take this entire system, brand it as your own, and sell it to your clients.

This is called a white-label model.

The end customer never sees Turnium’s name, but Turnium powers the whole experience behind the scenes.

This model is incredibly efficient. Instead of building a large in-house salesforce, Turnium grows by empowering its partners to sell. Managed service providers (MSPs), telecom resellers, consultants, and IT integrators all act as distribution engines.

They sell Turnium’s software, but under their own brand.

The Claratti Acquisition Changed Everything

In August 2024, Turnium acquired Claratti, an Australian telecom and cloud services company that had already embraced the white-label model and taken it to the next level. Claratti wasn’t just offering connectivity.

They were bundling everything a business might need, including cloud backups, endpoint security, ransomware protection, and even AI-powered marketing tools, and offering it through one easy-to-sell platform.

That acquisition was a turning point. Before Claratti, Turnium was primarily a product company.

After Claratti, they became a full-service solution provider. Instead of just solving connectivity, they now offer what the industry calls TaaS, or Technology-as-a-Service. Partners can resell the entire solution stack. Connectivity. Security. Automation. And they get to provide it all under their own name.

This feels like a utility. Customers pay every month.

The offering is “sticky”. And the more services a customer uses, the less likely they are to switch.

Claratti transformed Turnium from a niche vendor into a comprehensive partner for small and medium-sized businesses (SMBs) worldwide.

What the Numbers Are Telling Us

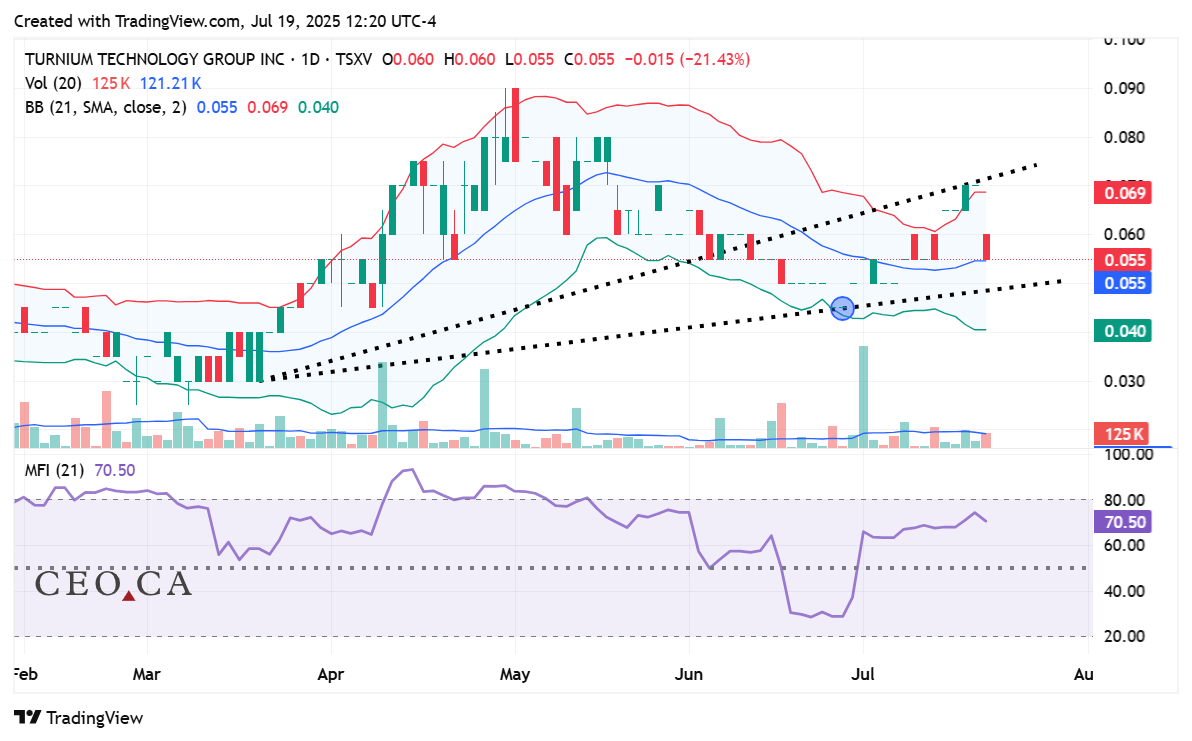

That shift is already showing up in the numbers. Turnium’s revenue grew 27 percent from Q4 2024 to Q1 2025, climbing from $1.55 million to $1.97 million.

Claratti now accounts for about 40 percent of that revenue and continues to bring in high-quality recurring deals, like its recent renewal with Tyro Payments.

Margins are strong. The company posted a blended gross margin of 68 percent in Q1. For every dollar of revenue, they kept 68 cents after delivery costs.

That’s healthy for a B2B SaaS model and shows the benefit of recurring, software-driven revenue. The goal is to get to 75%+ gross margins over time.

The most critical number, though, is EBITDA. In just six months, Turnium went from a $1.2 million loss in adjusted EBITDA to a $100,000 profit. That kind of swing tells you the business is getting leaner and more efficient as it grows. They also cut costs along the way. A 20 percent headcount reduction resulted in $1.1 million in annual savings. More revenue, lower costs, and better margins. That’s the path to scale.

A Recurring Revenue Machine

Right now, about 80 percent of Turnium’s revenue is recurring. That means it comes in every month, without needing to resell or restart the deal.

They’re aiming to push that to 85 percent as more partners expand their usage.

Each user generates anywhere from $50 to $250 per month. And when partners bundle in more services, things like cybersecurity upgrades, AI-driven marketing, or compliance tools, that number grows.

Internal models show that monthly revenue per partner could increase by as much as 390 percent, depending on how many modules they add.

This is where the flywheel starts to turn. Turnium signs up a partner. That partner sells to ten businesses.

Then they upgrade those businesses with more features. The partner makes more money. Turnium makes more money. And no one has to hire new salespeople or expand the overhead to do it.

Technology That’s Built to Last

Turnium’s core infrastructure is proprietary. They’re not licensing someone else’s software. They built their own hardware, called the Universal Edge Device (UED), that gets installed in each business location.

The UED handles all the traffic.

It intelligently routes data based on speed, reliability, and cost. It filters out threats before they reach the system.

It can also support massive data throughput of up to 100 gigabits per second. That’s enterprise-grade speed.

It also comes with zero-touch provisioning, which means a partner can ship the box to a customer anywhere in the world, and the customer can plug it in without an IT person on-site.

It configures itself and connects automatically.

And this is where it gets future-proof. The system is already ready for post-quantum cryptography (PQC), which is the next big wave in cybersecurity. It supports 5G connectivity out of the box. And it was built from day one to scale across global markets.

A partner in New York can use the same platform as a partner in Dubai, with no technical rewiring required.

Valuation Still Looks Cheap

Here’s the part that investors often overlook. Turnium is trading at around 1.3 times revenue. That means its enterprise value is just slightly higher than the annual revenue it’s bringing in. Most profitable SaaS companies with recurring revenue and a global footprint trade at 4 to 6 times revenue, sometimes even higher.

Turnium’s leadership team has set a target of reaching $100 million in revenue and $20 million in EBITDA by the end of fiscal 2027.

Whether or not they hit those exact numbers, the broader point is this. They believe the model is built to scale. The foundation is there. They are already profitable. They have recurring revenue. They have product-market fit. And they are doing it with very little fanfare.

A Team That Knows What It’s Doing

CEO Doug Childress has nearly four decades of experience in tech leadership. Chairman Ralph Garcea brings a mix of software, engineering and investment banking expertise, and was most recently on the board of Converge Technology Solutions (acquired by H.I.G. Capital for an enterprise value over C$1.4 billion).

The rest of the board has experience across telecom, finance, enterprise sales, and software. This is not a team of first-time founders learning on the fly.

They’ve run companies, scaled teams, and operated in global markets before.

Final Thought

Turnium is not trying to be a viral brand. They’re not hyping themselves on social media. What they are doing is quietly building the pipes and plumbing that make the modern digital economy run. They have Real clients. Real partners. Real revenue. And they’re growing it with strong margins, low overhead, and a clear strategy.

This newsletter was produced on behalf of Turnium Technology Group (TSXV: TTGI) and sponsored by the company. BeanWealth was compensated USD $1,750 by Senergy Communications Capital to create this content. This is not financial advice, and viewers are encouraged to consult a financial professional before making investment decisions. Investing involves significant risks, and past performance does not guarantee future results. Please see our full disclaimer https://www.senergy.capital/ttgi8392

Disclaimer for BeanWealth

BeanWealth is a publisher of financial education and information. We are not an investment advisor and do not provide personalized investment advice or recommendations tailored to any individual's financial situation. The content provided through our website, newsletters, and any other materials is for educational purposes only and should not be construed as financial or investment advice.

All information is provided “as is,” without warranty of any kind. BeanWealth makes no representations or guarantees regarding the accuracy, completeness, or timeliness of the information presented. The opinions and views expressed in our content are those of the author(s) and do not necessarily reflect the views of BeanWealth, its partners, or its affiliates.

Investors should perform their own due diligence and consult with a professional financial advisor before making any investment decisions. None of the information provided herein constitutes a solicitation to buy or sell any securities or financial instruments. Any projections or forecasts mentioned are speculative and subject to risks and uncertainties that could cause actual outcomes to differ.

BeanWealth, its employees, and affiliates may hold positions (long or short) in the securities or companies mentioned, and these positions may change without notice. No guarantees are made regarding the continuation of these positions.

Forward-looking statements, estimates, or forecasts provided are inherently uncertain and based on assumptions that may not occur. Other unforeseen factors may arise that could materially affect the actual outcomes or performance of the securities discussed. BeanWealth has no obligation to update or correct any information after the date of publication.

BeanWealth disclaims any liability for losses or damages, whether direct or indirect, resulting from the use of the information provided. By accessing or using any BeanWealth content, you agree to this disclaimer and our terms of service.

Unauthorized distribution, reproduction, or sharing of this content is strictly prohibited and subject to legal action.