- BeanWealth

- Posts

- New Rule Shakes Retirement Plans

New Rule Shakes Retirement Plans

Crypto Just Hit Your 401(k)...

This installment of BeanWealth is free for everyone. If you want to grow your portfolio with one high-upside stock idea every week—including two hand-picked by Matt Allen and two based on what billionaire investors and members of Congress are buying, with clear, easy-to-follow breakdowns that show you why it matters:

Good Evening! 👋

Welcome to Sunday’s Bean Breakdown. One of the biggest announcements in the history of 401Ks just happened. We have lots to talk about today!

HEADLINES

What You Need To Know

Nvidia said it expects to resume sales of its H20 AI chips to China after receiving assurances from the U.S. government that export licenses will be granted. The H20 chips had been blocked under April’s export curbs despite being tailored to meet earlier U.S. restrictions. The company said it hopes to begin deliveries soon, calling it a major step forward. CEO Jensen Huang met with President Trump last week to discuss AI policy, chip manufacturing, and America’s leadership in the space. Huang also introduced a new GPU, the RTX PRO, designed to meet export guidelines.

Netflix beat earnings expectations Thursday and raised its full-year revenue forecast to as high as $45.2 billion. That’s up from its previous range of $43.5 billion to $44.5 billion, thanks to stronger-than-expected subscriber growth, advertising sales, and a weaker dollar. Revenue in the second quarter jumped nearly 16% to $11.08 billion, and earnings hit $7.19 per share. Net income came in at $3.1 billion, up from $2.1 billion a year ago. Operating cash flow rose 84% to $2.4 billion, and free cash flow surged 91% to $2.3 billion. Netflix also posted a 34.1% operating margin, though it warned margins will shrink in the second half due to content and marketing costs tied to its packed release schedule. Despite the strong results, shares dipped about 1% in after-hours trading.

Amazon confirmed that it’s laying off employees in its cloud division, Amazon Web Services, as part of an internal reorganization. While the company didn’t specify how many people were affected, it said the cuts are focused on certain teams, including the AWS training and certification unit. The layoffs follow a third straight revenue miss for AWS, which posted $29.27 billion in Q1 sales, up 17% but slower than the prior quarter. Amazon said the cuts aren’t tied to its AI investments, but rather part of broader efforts to streamline operations and refocus priorities. CEO Andy Jassy has been trimming costs since 2022, resulting in over 27,000 job cuts. While the pace has slowed, layoffs continue across different business units. The company says it’s still hiring in key areas of AWS despite the recent reductions.

President Trump said Tuesday that the U.S. has reached a preliminary trade agreement with Indonesia, which includes a 19% tariff on Indonesian goods coming into the U.S. In exchange, Trump said American companies will gain tariff-free access to the Indonesian market for the first time. Speaking to reporters outside the White House, Trump emphasized the deal would bring “mutual benefit,” and claimed Indonesia had committed to buying $15 billion in U.S. energy, $4.5 billion in agricultural goods, and 50 Boeing jets, including 777s. Indonesia’s President Prabowo Subianto confirmed the call and the broader agreement in an Instagram post but didn’t mention specific terms. Commerce Secretary Howard Lutnick also suggested Indonesia would eliminate tariffs on U.S. exports.

PREMIUM RESEARCH

The Everyday Investor Club

If you want to grow your portfolio with one high-upside stock idea every week—including two hand-picked by Matt Allen and two based on what billionaire investors and members of Congress are buying, with clear, easy-to-follow breakdowns that show you why it matters:

OPINION

Matt Allen’s Take

Source: Bloomberg

There aren’t many executive orders that genuinely change markets.

But this one might.

President Trump just signed an order that allows Americans to invest in crypto directly through their 401(k) plans. And while it might sound like just another policy headline, I believe this is one of the most significant catalysts for crypto adoption we’ve ever seen.

Here’s why.

$8.7 Trillion of Firepower

Let’s start with the scale. Right now, there’s over $8.7 trillion sitting in 401(k) accounts. That’s just one piece of the broader $43 trillion retirement market. If even 1 percent of that flows into digital assets, we’re talking about nearly $90 billion in potential new capital for crypto.

At 5 percent? That’s over $400 billion.

To put that in perspective, the entire crypto market today is worth just over $4 trillion. A few hundred billion dollars from retirement accounts wouldn’t just push prices higher; it would stabilize the space and help bring a level of maturity the market has never seen.

Why This Executive Order Matters

This isn’t just about Bitcoin showing up as an option in your Fidelity app. It’s about the federal government opening the door for digital assets to be treated like any other long-term investment.

The order instructs regulators to eliminate barriers to crypto within retirement plans. That means the Department of Labor and the SEC are now tasked with helping plan providers build pathways, not blocking them.

This comes just months after the Labor Department rolled back the previous administration’s stance against crypto. We’re now seeing a full pivot: from “avoid this risky asset” to “let’s make it accessible and secure.”

And it’s not just crypto. The executive order also opens 401(k) plans to private equity, infrastructure funds, and even physical gold. It’s a full-blown push toward investment optionality.

But crypto is the headline. And for good reason.

Why This Could Be the Tipping Point

Crypto has always struggled with two things: trust and access.

Retirement plans solve both.

401(k)s are governed by strict fiduciary rules. Plan sponsors are legally required to act in the best interest of participants. If digital assets make it into these plans, it’s because institutional players believe they are viable long-term investments.

That’s a huge credibility signal.

And on the access side, it’s even more important. Right now, most Americans don’t have a Coinbase or Kraken account. But nearly 74 million workers have access to a 401(k). That means we’re no longer talking about tech-forward millennials speculating on altcoins. We’re talking about teachers, engineers, factory workers, and small business employees gaining direct exposure to Bitcoin and Ethereum automatically, through payroll deductions.

That’s a game changer.

Will It All Flood In Overnight?

Of course not.

Institutional money doesn’t sprint into new asset classes. It walks. It tests the plumbing. It builds infrastructure. Then it walks faster.

We saw this play out with Bitcoin ETFs. At first, it was just a few billion. Now it’s over $70 billion. The same pattern will likely repeat here. Providers like Fidelity, BlackRock, and Vanguard already have crypto capabilities. Now they have a new customer base to serve.

Even if it takes two to three years, the long-term impact could be massive.

What This Means for the Market

There are three key effects I’m watching.

First, liquidity. Retirement contributions are steady, long-term, and consistent. That’s exactly the kind of buyer base crypto has been missing. With more stable inflows, we could see reduced volatility and stronger price floors.

Second, legitimacy. Once crypto is embedded in retirement plans, the perception shifts. It’s no longer just a speculative bet. It becomes part of the long-term wealth-building conversation.

And third, professionalization. Institutional managers bring structure. They bring models, risk frameworks, and better price discovery. This could be the bridge from retail chaos to a real financial ecosystem.

This executive order is the biggest step toward mainstream crypto adoption I’ve seen in years.

Not because it pumps prices tomorrow. But because it unlocks access to the most trusted financial system in the country, retirement.

If you’ve been waiting for the moment crypto stops being a fringe asset and starts becoming infrastructure, this might be it.

Every Thursday, I send premium members one high-conviction stock idea. I send them two high conviction stocks from myself plus two stocks tracked from billionaire investors and members of Congress—so you know what they’re buying and why they’re betting big.

UPCOMING

What You Need To Watch

On Wednesday, June existing home sales data is released. Mortgage rates are still hovering near 7 percent, and inventory remains tight. If sales continue to slide, it signals ongoing pressure in the housing market, especially for first-time buyers. I’ll also be watching regional breakdowns for signs of activity shifting.

On Thursday, we get the July flash S&P Global Manufacturing PMI. This will be an early look at how factory activity is holding up in Q3. I’m focused on new orders and input prices; any pickup there could point to renewed inflation pressure or a turnaround in industrial demand.

On Thursday, June new home sales data is also released. Unlike the resale market, new construction has been more resilient.

On Friday, June durable goods orders come out. This is a direct read on business investment and long-cycle spending.

TIP

Why I Watch for Share Dilution Before Buying a Stock

One thing I always check before investing in a company is whether it's diluting its shares. When a company issues more stock, it increases the number of shares outstanding, which can reduce the value of each existing share.

It might not seem like a big deal at first, but over time, dilution can quietly erode your ownership and limit your upside. I look at the share count over the past few years and check if management is using equity to raise cash or fund excessive stock-based compensation. A great business should be growing its value not constantly shrinking your piece of it.

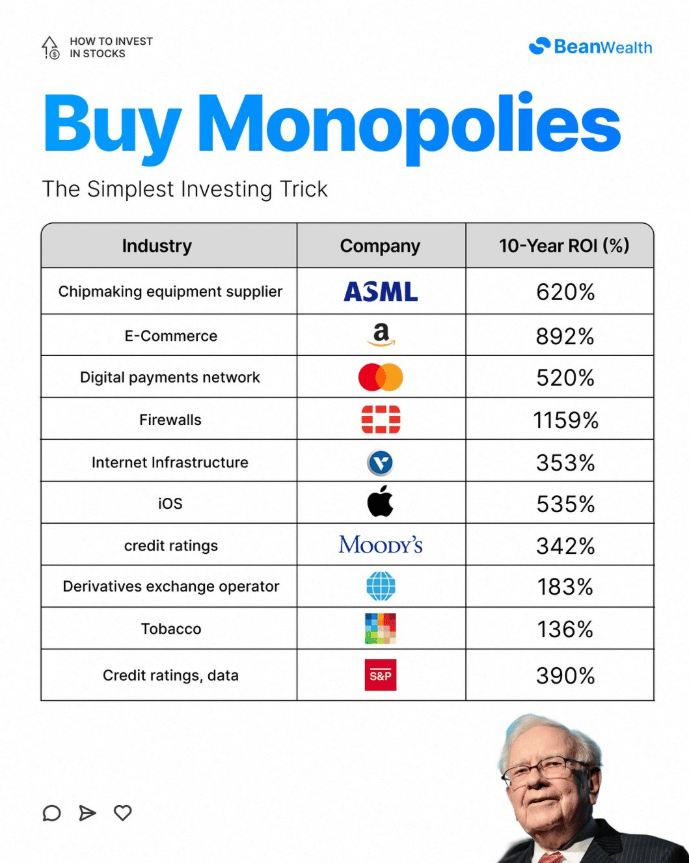

CHART

BUY MONOPOLIES

Source: @bean_wealth

TERM

Unit Economics

Unit economics breaks down the profitability of a single product, customer, or transaction. I use it to figure out whether growth is actually creating value or just masking losses.

For example, if it costs a company $50 to acquire a customer who generates $200 in lifetime revenue and $100 in gross profit, the unit economics are solid. But if that customer only brings in $40 in gross profit, scaling faster just burns more cash.

Strong unit economics tell me the business can become profitable as it grows. Weak ones mean no amount of growth will fix the model.

See you on Wednesday!

Cheers,

Matt Allen

Disclaimer:

This content is for informational and educational purposes only and does not constitute financial, investment, or trading advice. BeanWealth is not a registered investment adviser, broker-dealer, or financial planner. You should not construe any material in this newsletter or related social media posts as a recommendation, solicitation, or offer to buy or sell any securities.

On July 7, 2025, BeanWealth received $1,900 from Vistagen (Nasdaq: VTGN) to publish a sponsored feature in our newsletter and related posts on our social media platforms. This is a paid marketing communication. The views expressed are our own and do not reflect the views of Vistagen or its management.

Investing in stocks involves risk, including the potential loss of principal. Always do your own research and consult with a licensed financial professional before making any investment decisions.

BeanWealth and its affiliates make no representations or warranties about the accuracy or completeness of any forward-looking statements or projections discussed.

Disclaimer for BeanWealth

BeanWealth is a publisher of financial education and information. We are not an investment advisor and do not provide personalized investment advice or recommendations tailored to any individual's financial situation. The content provided through our website, newsletters, and any other materials is for educational purposes only and should not be construed as financial or investment advice.

All information is provided “as is,” without warranty of any kind. BeanWealth makes no representations or guarantees regarding the accuracy, completeness, or timeliness of the information presented. The opinions and views expressed in our content are those of the author(s) and do not necessarily reflect the views of BeanWealth, its partners, or its affiliates.

Investors should perform their own due diligence and consult with a professional financial advisor before making any investment decisions. None of the information provided herein constitutes a solicitation to buy or sell any securities or financial instruments. Any projections or forecasts mentioned are speculative and subject to risks and uncertainties that could cause actual outcomes to differ.

BeanWealth, its employees, and affiliates may hold positions (long or short) in the securities or companies mentioned, and these positions may change without notice. No guarantees are made regarding the continuation of these positions.

Forward-looking statements, estimates, or forecasts provided are inherently uncertain and based on assumptions that may not occur. Other unforeseen factors may arise that could materially affect the actual outcomes or performance of the securities discussed. BeanWealth has no obligation to update or correct any information after the date of publication.

BeanWealth disclaims any liability for losses or damages, whether direct or indirect, resulting from the use of the information provided. By accessing or using any BeanWealth content, you agree to this disclaimer and our terms of service.

Unauthorized distribution, reproduction, or sharing of this content is strictly prohibited and subject to legal action.