- BeanWealth

- Posts

- China’s Grip on Your Investments

China’s Grip on Your Investments

From EVs to AI, one country controls the core materials...

This installment of BeanWealth is free for everyone. If you want to grow your portfolio with one high-upside stock idea every week—including two hand-picked by Matt Allen and two based on what billionaire investors and members of Congress are buying, with clear, easy-to-follow breakdowns that show you why it matters:

Good Evening! 👋

Welcome to Sunday’s Bean Breakdown. You can’t build a fighter jet or an EV without this one thing. And the U.S. doesn’t control it. We have lots to talk about today!

HEADLINES

What You Need To Know

The S&P 500 hit another record today after shaking off more tariff talk from President Trump. He said trade talks with Canada are officially off, but markets didn’t flinch. The index closed at 6,173 and climbed as high as 6,187 earlier in the session. The Nasdaq and Dow also finished at all-time highs. What drove the move? Commerce Secretary Howard Lutnick told Bloomberg that the U.S. finalized a trade deal with China and is close to striking agreements with 10 other partners. That optimism helped fuel the rally. It’s a sharp turnaround from April, when the S&P was down nearly 18 percent after Trump first pushed steep tariffs. Since then, he’s backed off and markets have taken off.

Novo Nordisk is cutting ties with Hims & Hers. The Danish drugmaker said the telehealth company failed to follow federal law by continuing to sell knock-off versions of Wegovy under the “false guise” of personalization, even after the drug was no longer in shortage. Novo accused Hims & Hers of deceptive marketing and putting patient safety at risk. Shares of Hims & Hers plunged more than 34% on the news. Novo’s stock also slipped more than 5%. The breakup raises legal risks for Hims & Hers and puts a spotlight on compounded weight-loss meds sourced from unregulated suppliers in China.

Nike is finally turning the corner after an ugly stretch. Sales dropped 12%, profits fell 86%, and yet the stock jumped 10% after earnings. Why? Wall Street thinks the worst might be over. But there’s a new problem: tariffs. Nike says fresh China import costs could hit $1 billion this year. They’re reworking the supply chain, raising prices, and cutting back on digital to get leaner. CEO Elliott Hill says it’s time to get back to sports. The Amazon partnership is back. The A’ja Wilson drop sold out in 3 minutes. Nike’s not fixed yet, but the fight is back.

Anthropic just scored a major legal win. A federal judge ruled that using books to train its Claude AI model qualifies as “fair use” and “transformative.” That’s a big deal for the AI industry, which has been under fire for how models get trained. The judge compared Claude’s training to “any reader aspiring to be a writer.” It didn’t copy creative elements or styles, so copyright laws weren’t broken. The catch? A separate trial is still coming over 7 million pirated books Anthropic initially used. They stopped using them, but damages could still follow.

Tesla’s long-promised robotaxi service officially launched in Austin. The initial rollout includes a small fleet of Model Ys, not the futuristic CyberCab, and the rides are invite-only, limited to a geofenced area of the city. A Tesla Safety Monitor is required in the front passenger seat, with remote operators watching each trip. Elon Musk said the first driverless ride from factory to customer is expected on his birthday, June 28. But not everyone is celebrating. Lawmakers and public safety advocates are urging Tesla to delay the service until new Texas self-driving laws take effect in September.

Krispy Kreme and McDonald’s are calling it quits. Starting July 2, you’ll no longer find those doughnuts at McDonald’s locations. The partnership had reached 2,400 restaurants but proved unsustainable for Krispy Kreme. CEO Josh Charlesworth said demand just didn’t match the cost. McDonald’s said the pilot was positive on their end but understood it needed to work financially for both sides. Krispy Kreme will now focus on high-volume retail and global growth, while McDonald’s continues to battle slowing sales and shifting consumer habits.

OPINION

Matt Allen’s Take

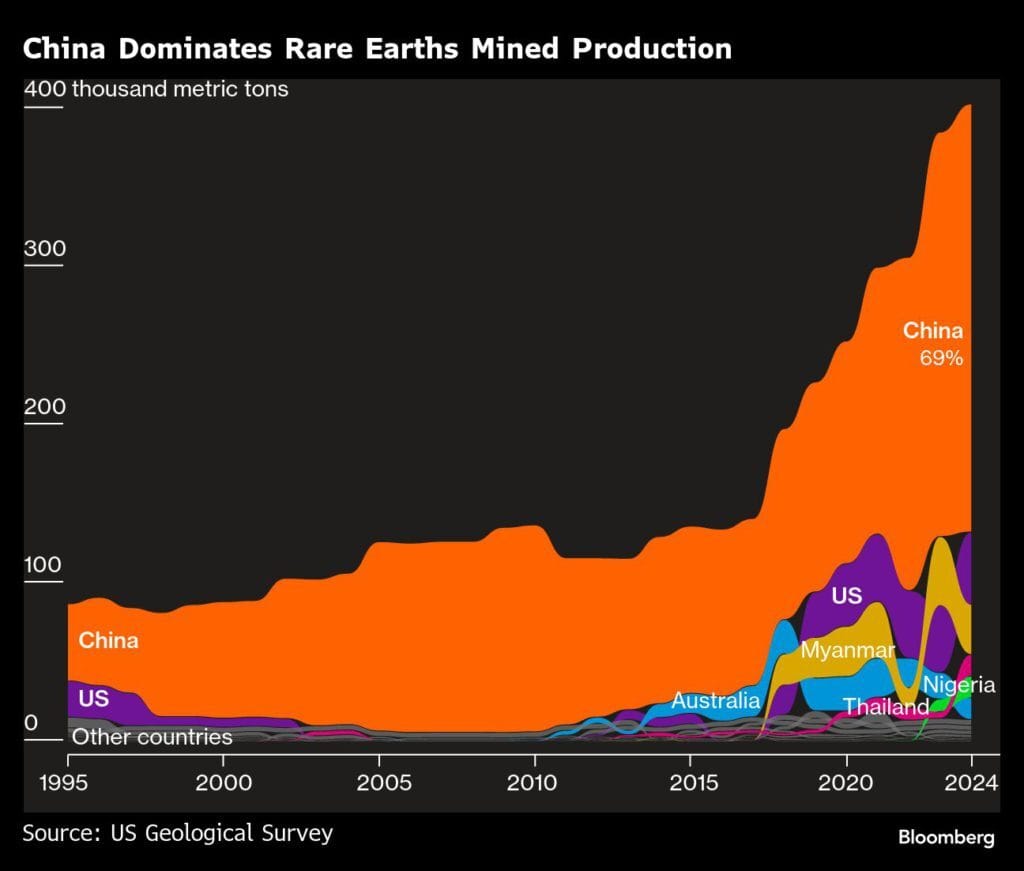

Source: Bloomberg

The next economic war won’t start with bullets. It will start with minerals. And right now, China controls nearly all of them. The kind that power everything from smartphones and fighter jets to EVs and artificial intelligence.

The United States may lead in tech, but when it comes to the metals that make that tech possible, China holds the cards. They dominate the rare earth supply chain. And they are not afraid to use it as leverage.

Rare earth elements are not actually rare. You can find them all over the world. But they are hard to process, and the work is messy, expensive, and sometimes toxic. Most countries chose not to deal with it.

China did. They leaned into it early. Today, they produce nearly 70 percent of global supply and refine more than 85 percent. That includes nearly all of the heavy rare earths used in defense and high-performance technologies. Even ore mined in the U.S. often gets shipped to China just to be processed.

That is the real issue. You cannot build electric vehicles, AI chips, or fighter jets without these metals. And if one country controls the supply chain, they hold enormous power in a tech-driven world.

Now, they are flexing that power.

This spring, China tightened export rules on several key rare earths. Companies can no longer freely ship them out. They need special government approval.

The last time something like this happened, prices spiked 10x and Western supply chains buckled. It is starting again.

Factories in Europe are pausing production. Magnet suppliers are warning about delays. U.S. defense contractors are raising red flags. If the flow gets cut off again, this is not just a trade problem. It is a national security issue.

Every F-35 jet uses nearly 1,000 pounds of rare earth materials. A single Virginia-class submarine needs nine times that amount. Without access to these metals, our military systems, tech platforms, and supply chains all take a hit.

And this does not just affect defense. Your phone, your car, your wireless earbuds, even your tv, they all rely on rare earths like neodymium, terbium, and dysprosium.

Right now, the U.S. is trying to negotiate. The Trump administration is offering to loosen restrictions on some chip and materials exports in return for more consistent access to rare earths.

There has been a tentative agreement. But China says it will evaluate each export request under its own legal framework. That means approvals will happen when and how they want. We are not in control of this situation.

And here is something most people do not realize. Mining is not the biggest hurdle. Processing is. The U.S. can dig up the materials, but almost all refining still takes place overseas.

It takes years to develop that infrastructure. Even with fast-track permits, a new facility takes three to five years to build. A new mine can take closer to ten.

That is why the Pentagon is pumping money into domestic projects. Congress approved over a billion dollars to start stockpiling these materials. The U.S. is also cutting deals with Australia, Canada, and even Greenland. In fact, Greenland sits on one of the world’s largest untapped rare earth deposits. Back in 2019, Trump floated buying the island for exactly this reason: to secure a friendly, resource-rich foothold far from Beijing’s reach. And in 2025, he is still talking about it today as you might know.

But we are not self-sufficient yet. And until we are, China knows exactly how much influence it has.This is not just about trade policy. It is about global leverage. The kind that touches everything from your electric bill to your investment portfolio.

That is why on Thursday, I am sending out a full stock breakdown on one of the only U.S.-based companies trying to fix this. They are building out domestic capacity. They are backed by BlackRock. And a LEGENDARY billionaire investor just took a massive position.

The stock trades at $13. And no one is talking about it.

If you want the full writeup the name, the thesis, and the full 3,000 word research on why it matters make sure you are on the premium list by Thursday. This rare earth story is not only coming. It is already here.

UPCOMING

What You Need To Watch

On Tuesday, Fed Chair Powell speaks again, just days after his Congressional testimony. Last week, he held firm on staying cautious, with seven FOMC members projecting no cuts in 2025. I’ll be listening closely for any shift in tone, especially as markets continue to price in more easing than the Fed is signaling.

On Tuesday, June ISM Manufacturing PMI data comes out. Manufacturing has been weak for over a year, but tariff noise and energy prices are distorting the picture. I’ll be watching for signs of pricing pressure in the “prices paid” component, which could feed back into inflation expectations.

On Tuesday, we also get May JOLTS data. Job openings have been trending lower, but the key number I’m watching is the quits rate. If fewer workers are confident enough to leave their jobs, it’s a sign that the labor market is starting to soften.

On Wednesday, June ADP employment data drops. Expectations are muted after recent labor reports, but ADP still offers a preview of private-sector hiring. If wage growth stays hot, it adds fuel to the inflation story and could keep the Fed cautious.

On Thursday, the June jobs report is the main event. Forecasts are calling for just 110,000 jobs added, down from 139,000 in May. If unemployment ticks up to 4.3 percent or higher and continuing claims stay elevated, that would reinforce the slowdown narrative. But with wage growth still around 3.9 percent, the Fed won’t have a clear green light to cut.

On Friday, U.S. markets are closed for the Fourth of July. With the jobs report hitting the day before, expect traders to reposition early and volume to thin out quickly heading into the long weekend.

TIP

Why I Track My Savings Rate, Not Just My Budget

At a certain point, budgeting every dollar becomes less useful than understanding your overall savings rate. Your savings rate is the percentage of your income you’re saving instead of spending. I track my savings rate monthly. It tells me how aggressive I’m being with my financial goals and gives me a clear benchmark to improve. For example, if I earn $10,000 in a month and save $2,500, my savings rate is 25 percent. If my income goes up but my savings rate stays the same, I know I’m just spending more rather than building wealth. You don’t need to cut every expense, you just need to consistently save a meaningful portion of what you earn.

CHART

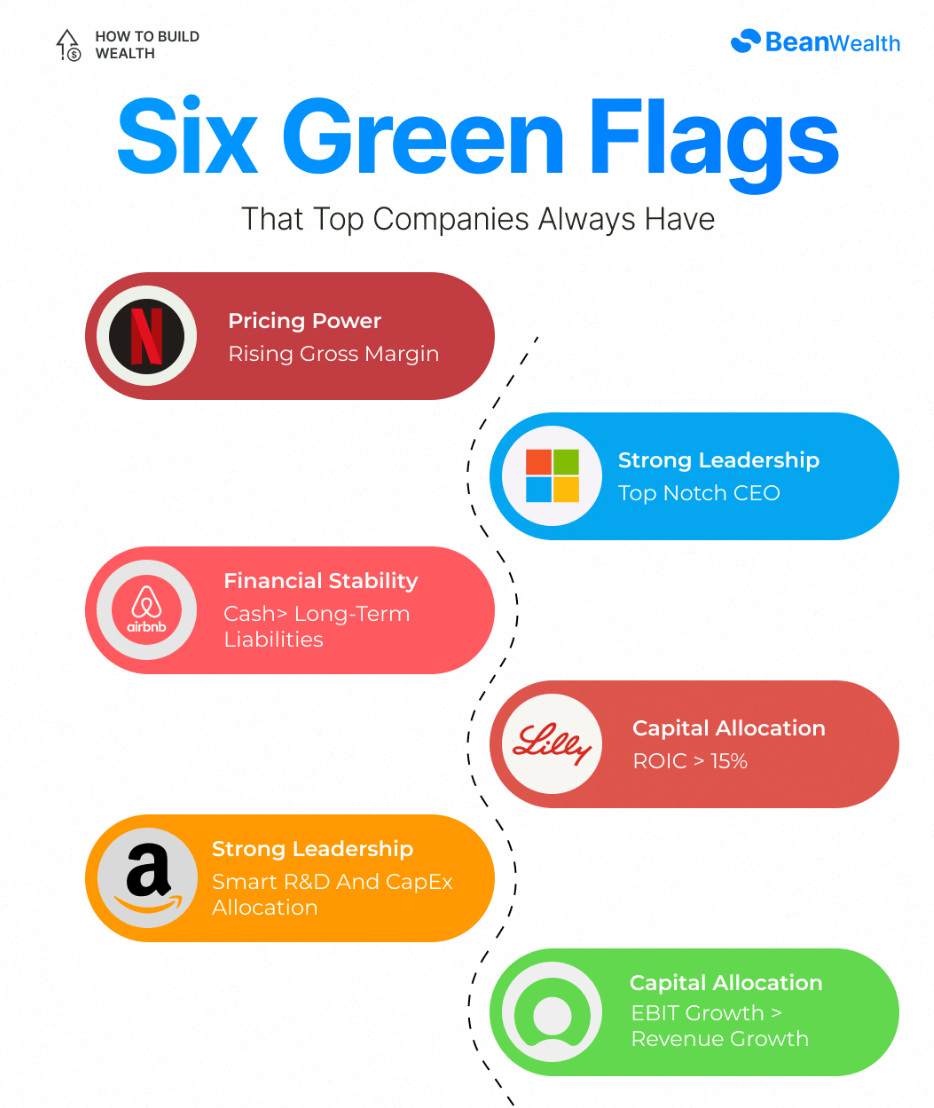

SIX GREEN FLAGS

Source: @bean_wealth

TERM

Share Dilution

Share dilution happens when a company issues more shares, which reduces the ownership percentage of existing shareholders. I always pay attention to this because it quietly chips away at your piece of the pie.

Let’s say you own 1 percent of a company, and then it issues a bunch of new shares to raise capital or reward executives with stock-based compensation. Your 1 percent might drop to 0.8 percent without you selling a single share.

I don’t avoid dilution entirely, but I want to see that the new shares are funding growth or adding value. If not, it’s a red flag.

See you on Wednesday!

Cheers,

Matt Allen

Disclaimer for BeanWealth

BeanWealth is a publisher of financial education and information. We are not an investment advisor and do not provide personalized investment advice or recommendations tailored to any individual's financial situation. The content provided through our website, newsletters, and any other materials is for educational purposes only and should not be construed as financial or investment advice.

All information is provided “as is,” without warranty of any kind. BeanWealth makes no representations or guarantees regarding the accuracy, completeness, or timeliness of the information presented. The opinions and views expressed in our content are those of the author(s) and do not necessarily reflect the views of BeanWealth, its partners, or its affiliates.

Investors should perform their own due diligence and consult with a professional financial advisor before making any investment decisions. None of the information provided herein constitutes a solicitation to buy or sell any securities or financial instruments. Any projections or forecasts mentioned are speculative and subject to risks and uncertainties that could cause actual outcomes to differ.

BeanWealth, its employees, and affiliates may hold positions (long or short) in the securities or companies mentioned, and these positions may change without notice. No guarantees are made regarding the continuation of these positions.

Forward-looking statements, estimates, or forecasts provided are inherently uncertain and based on assumptions that may not occur. Other unforeseen factors may arise that could materially affect the actual outcomes or performance of the securities discussed. BeanWealth has no obligation to update or correct any information after the date of publication.

BeanWealth disclaims any liability for losses or damages, whether direct or indirect, resulting from the use of the information provided. By accessing or using any BeanWealth content, you agree to this disclaimer and our terms of service.

Unauthorized distribution, reproduction, or sharing of this content is strictly prohibited and subject to legal action.