- BeanWealth

- Posts

- A Junior Gold Developer On The Move

A Junior Gold Developer On The Move

Good Morning! 👋

Revival Gold: A Junior Gold Developer With Two Flagship Projects in America’s Backyard

Please read the full disclaimer at the bottom of the page. Disseminated on behalf of Revival Gold Inc

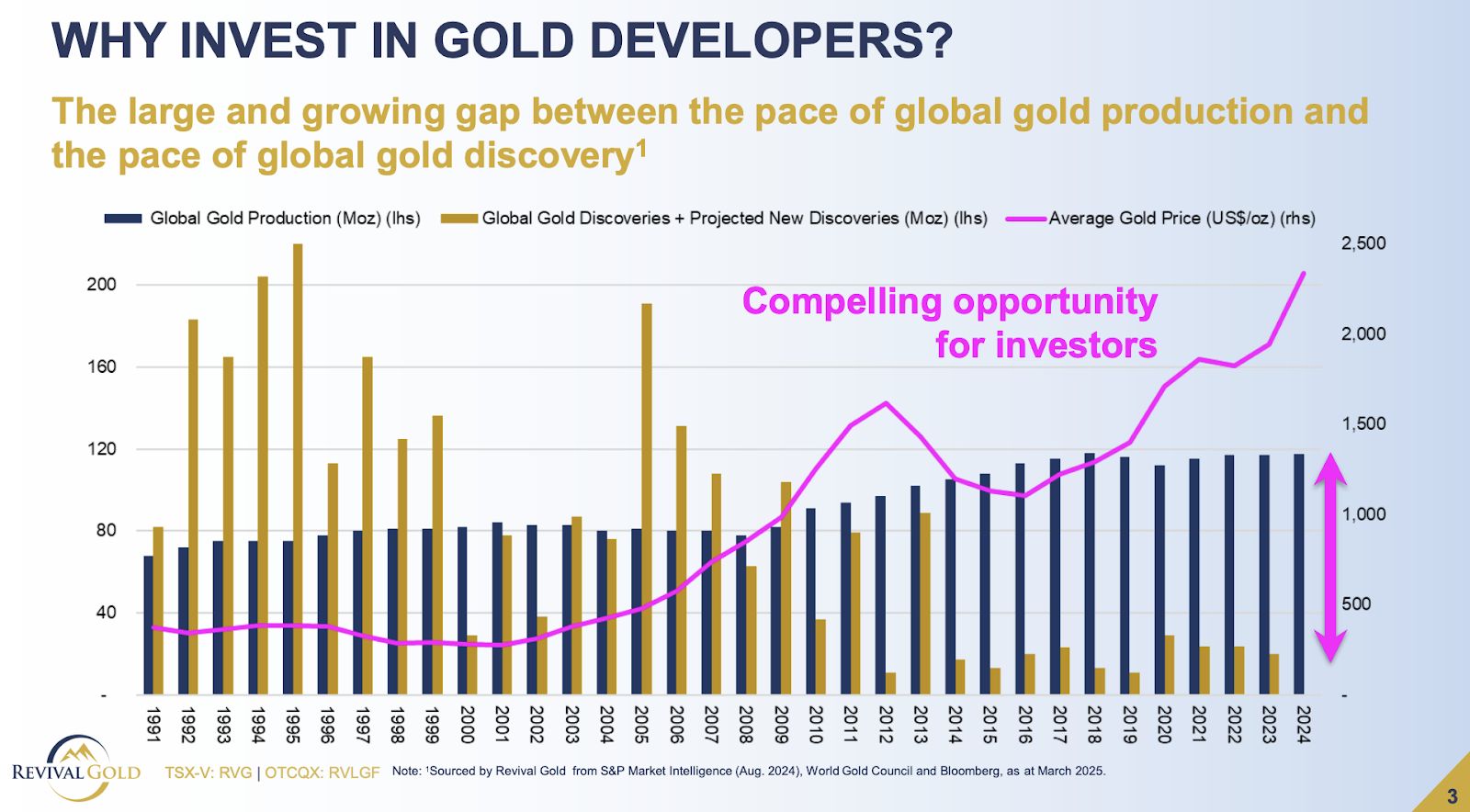

Gold is having a moment in 2025.

With the yellow metal setting new all-time highs above $3,200 per ounce, the tide has clearly shifted. Sticky inflation, fiat currency concerns, and geopolitical volatility are pushing investors back toward a safe haven they had mostly ignored over the past few years.

And this time, it’s not just traditional gold bulls leading the charge.

Central banks are buying at a record pace. Generalist investors are returning. And perhaps most importantly, small-cap gold explorers in Tier-1 mining jurisdictions are back in focus.

One company that stands out is Revival Gold Inc. (TSX-V: RVG | OTC: RVLGF). They’re advancing two past-producing, high-grade gold projects in the United States — Beartrack-Arnett in Idaho and Mercur in Utah — at a time when market interest in North American gold stories is heating up.

Let’s take a closer look at why this company is starting to draw attention.

Why Gold Now?

Gold is rallying for multiple reasons. Central banks, led by China and Russia, are buying gold to hedge against potential sanctions and diversify away from the U.S. dollar. Retail and institutional investors are rotating back into gold after a long detour into crypto and tech.

Even long-time skeptics are starting to see it differently.

Rick Rule once said the best bull markets “grind higher,” not spike straight up. We’re seeing that dynamic play out now. Gold has established a new floor above $3,000 per ounce, and some analysts believe it could climb to $3,500 or beyond in the next year.

This macro backdrop is creating ideal conditions for gold developers with large, low-cost resources in safe jurisdictions.

Beartrack-Arnett: Revival’s Flagship in Idaho

Revival’s core asset is the Beartrack-Arnett gold project in eastern Idaho. It’s a past-producing mine with strong infrastructure already in place, including a processing plant, solution ponds, roads, hydropower, and water treatment facilities.

Since 2018, Revival has grown the resource from 2 million ounces to 4.6 million ounces of pure gold across all categories. Importantly, the discovery cost has remained under $5 per ounce, which is incredibly efficient for the industry.

Beartrack-Arnett is located along the Panther Creek Shear Zone, a major structural corridor known for hosting gold. The project is 100 percent owned and sits just ten miles from the town of Salmon, Idaho.

The company recently completed a Preliminary Feasibility Study (PFS) that outlines a phased development approach. The first phase focuses on a restart of open-pit heap leach production from near-surface oxide material. Future phases may include higher-grade underground zones.

Revival has drilled high-grade intercepts at depth, particularly in the Joss Zone, where results include 10 grams per tonne gold over 11 meters. There’s strong potential to expand both the surface and underground resource base.

Mercur: A Strategic Acquisition in Utah

In 2024, Revival acquired Ensign Minerals and its Mercur project in Utah. This past-producing mine adds another 1.64 million ounces of gold and brings Revival’s total resource base to 6.2 million ounces.

Mercur is a Carlin-style system that historically produced 2.6 million ounces of gold. Nearly a million of those ounces came from ore grading 7 grams per tonne, which hints at the potential for high-grade zones at depth.

The project is located on private land, which allows for an accelerated permitting timeline. Revival recently released a Preliminary Economic Assessment (PEA) showing strong economics: a $752 million after-tax NPV and 57 percent internal rate of return at $3,000 gold. Even at a more conservative $2,175 per ounce, the project still carries a $294 million NPV.

The plan is to produce an average of 95,600 ounces of gold per year over a 10-year mine life, with all-in sustaining costs of $1,363 per ounce. Pre-production capital is estimated at $208 million, with a two-year payback period at current prices.

Hub-and-Spoke Potential

With two development-stage assets located just 560 kilometers apart, Revival is exploring a potential hub-and-spoke mining model. The idea would be to use the existing processing facility at Beartrack-Arnett and potentially truck ore from Mercur to that site.

This kind of setup could reduce costs and create efficiencies, especially as both properties are past-producers with solid infrastructure.

The combined production target is 150,000 ounces of gold per year in the first phase, with expansion potential to 250,000 ounces annually by including higher-grade underground zones.

Exploration Upside

While both projects have strong economic studies in place, exploration is still a major part of the story.

At Beartrack-Arnett, the company recently expanded its land package to include 57 new claims south of the Joss Zone. A new target, Sharkey, could hold similar or even greater potential than what’s been discovered at Joss. This zone is already permitted for drilling.

At Mercur, drilling has only scratched the surface. The team believes there is deeper high-grade mineralization yet to be defined. They’ve already seen gold recovery rates between 74 and 92 percent across multiple column leach tests, indicating the rock is amenable to standard processing.

Leadership and Financial Backing

Revival is led by Hugh Agro, a former Kinross and Placer Dome executive with deep experience in the gold sector. He is joined by a team of engineers and geologists with track records at majors like Barrick and Meridian.

In March 2025, the company raised over $10 million through private placements, including a strategic investment from Dundee Corporation, which now holds about 5 percent of the company. Institutional ownership overall sits near 48 percent, with insiders holding an additional 15 percent.

There are fewer than 260 million shares fully diluted, and the company remains tightly held by long-term stakeholders.

Final Thoughts

Revival Gold is not yet in production, but it is advancing two past-producing gold projects in politically safe jurisdictions with significant infrastructure, strong economics, and meaningful exploration upside.

As always, this writeup is intended for informational purposes only. It is not financial advice or a recommendation to buy or sell securities.

That said, with gold trading at record highs and institutional capital beginning to return to the space, Revival Gold is one of the more advanced small-cap developers to keep an eye on.

You can learn more about the company and access its latest corporate presentation at revival-gold.com.

DISCLAIMER

This newsletter is for informational purposes only and does not constitute investment advice, an offer to buy or sell securities, or a recommendation regarding any specific company. All information presented is based on publicly available sources believed to be accurate at the time of writing, but no guarantees are made as to its completeness or reliability. Investors should always conduct their own due diligence and consult a licensed financial advisor before making any investment decisions.

BeanWealth was compensated by Resource Stock Digest to produce and distribute this newsletter. As such, this is a paid communication and should be considered advertorial in nature. We do not own shares in the company mentioned and therefore do not benefit from price appreciation.

Statements made in this newsletter may contain forward-looking information, including but not limited to estimates of future production, resource growth, project economics, and financing outcomes. These statements are subject to various risks and uncertainties that could cause actual results to differ materially. Revival Gold Inc. trades on the TSX Venture Exchange under the symbol RVG and on the OTCQX under the symbol RVLGF. Investors are encouraged to review the company's official filings at sedarplus.ca and sec.gov before making investment decisions.

Disclaimer for BeanWealth

BeanWealth is a publisher of financial education and information. We are not an investment advisor and do not provide personalized investment advice or recommendations tailored to any individual's financial situation. The content provided through our website, newsletters, and any other materials is for educational purposes only and should not be construed as financial or investment advice.

All information is provided “as is,” without warranty of any kind. BeanWealth makes no representations or guarantees regarding the accuracy, completeness, or timeliness of the information presented. The opinions and views expressed in our content are those of the author(s) and do not necessarily reflect the views of BeanWealth, its partners, or its affiliates.

Investors should perform their own due diligence and consult with a professional financial advisor before making any investment decisions. None of the information provided herein constitutes a solicitation to buy or sell any securities or financial instruments. Any projections or forecasts mentioned are speculative and subject to risks and uncertainties that could cause actual outcomes to differ.

BeanWealth, its employees, and affiliates may hold positions (long or short) in the securities or companies mentioned, and these positions may change without notice. No guarantees are made regarding the continuation of these positions.

Forward-looking statements, estimates, or forecasts provided are inherently uncertain and based on assumptions that may not occur. Other unforeseen factors may arise that could materially affect the actual outcomes or performance of the securities discussed. BeanWealth has no obligation to update or correct any information after the date of publication.

BeanWealth disclaims any liability for losses or damages, whether direct or indirect, resulting from the use of the information provided. By accessing or using any BeanWealth content, you agree to this disclaimer and our terms of service.

Unauthorized distribution, reproduction, or sharing of this content is strictly prohibited and subject to legal action.