- BeanWealth

- Posts

- A Gold Project Built for Today’s Market

A Gold Project Built for Today’s Market

How Choquelimpie Is Being Methodically Advanced

Gold is not setting up anymore. It has already broken out.

With prices sitting at all-time highs, the conversation has shifted away from whether gold matters and toward a much more practical question. Where does the next generation of supply come from?

That question is becoming more important by the day. Central banks continue to accumulate gold. Fiscal deficits remain elevated. Real assets are back in focus. And unlike prior cycles, this move higher is happening while mine supply remains constrained.

When gold reaches new highs, the market naturally starts looking down the food chain. Attention moves from the metal itself to the projects that could realistically deliver new ounces into a tightening supply environment. Not speculative ideas, but assets with history, location, and a path forward.

That is what led me to spend time on Norsemont Mining Corp. (OTC: NRRSF).

This is not a story about chasing momentum. It is about understanding where value can emerge when gold prices are already doing the heavy lifting. Norsemont controls a historically defined gold project in one of the most established mining jurisdictions in the United States, and the timing of that matters more now than it did a year ago.

At all-time highs, gold does not reward theory. It rewards execution.

Why Advanced Gold Projects Matter More at High Prices

When gold trades at all-time highs, the biggest mistake investors make is assuming every gold company benefits equally. They do not.

In reality, rising prices tend to separate projects that are simply early ideas from those that already have substance. The market starts favoring assets with historical work, known geology, existing infrastructure, and clear jurisdictional pathways. These are the projects that can realistically move forward when capital becomes available.

That distinction matters because new gold supply is not easy to bring online. Discovery rates have declined for decades. Permitting has become more complex. And even well-capitalized producers are struggling to replace depleted ounces. As prices rise, the incentive shifts toward projects that shorten the timeline between exploration and potential development.

This is where Norsemont Mining Corp. (OTC: NRRSF) begins to stand out.

Rather than starting from scratch, Norsemont is advancing a project with a long operational history and extensive prior data. Historical mining and exploration work provide a foundation that modern operators can reassess using updated geological models, modern drilling techniques, and current economic assumptions. That does not eliminate risk, but it materially reduces uncertainty compared to greenfield exploration.

Location also plays a critical role. Projects in established U.S. mining states benefit from existing roads, power access, skilled labor pools, and a regulatory framework that understands mining. When gold prices are high, these factors are no longer secondary. They directly influence whether a project can attract partners, financing, or strategic interest.

At this stage of the gold cycle, investors tend to reward clarity. They look for projects that can be evaluated on tangible factors rather than distant potential. Assets with historical resources, defined targets, and a clear development narrative often move into focus as the market looks ahead rather than backward.

That is the environment Norsemont is operating in today.

How the Project Is Being Advanced From Here

With the groundwork already established, Norsemont Mining Corp. (OTC: NRRSF) is focused on moving Choquelimpie forward in a disciplined, step-by-step way rather than rushing toward development assumptions. The emphasis is on upgrading confidence in the asset while preserving flexibility.

The first priority for Norsemont Mining Corp. (OTC: NRRSF) is validating and modernizing the historical database. While Choquelimpie benefits from extensive past drilling and metallurgical work, much of that data predates current reporting standards. The company’s plan centers on confirming historical results, integrating them into a modern geological model, and identifying where additional drilling can meaningfully improve continuity and scale.

From there, the advancement path focuses on selective, targeted drilling rather than broad exploration. Instead of drilling to “see what’s there,” Norsemont Mining Corp. (OTC: NRRSF) intends to test specific areas where historical data, structure, and mineralization trends overlap. This approach is designed to add incremental value with each program, whether by expanding known zones, improving grade distribution, or extending mineralization at depth.

Another key element of the strategy is maintaining optionality. Choquelimpie contains both oxide and sulfide mineralization, which allows Norsemont Mining Corp. (OTC: NRRSF) to evaluate multiple development pathways over time. Near-surface material offers a different economic profile than deeper zones, and management has been clear that the goal is not to force a single outcome too early. Keeping those options open allows future decisions to be informed by results rather than assumptions.

Capital discipline is also central to the plan. Norsemont Mining Corp. (OTC: NRRSF) is not attempting to fast-track construction or lock in a development model prematurely. Instead, the focus remains on advancing the technical understanding of the project while controlling spending and minimizing unnecessary dilution. That approach is consistent with how advanced projects are typically positioned ahead of larger strategic decisions.

Importantly, the advancement strategy is designed to make the project easier to evaluate by third parties. Each technical milestone, whether it is additional drilling, updated modeling, or future studies, is meant to reduce uncertainty and sharpen the picture of what Choquelimpie could become. That clarity matters not only for internal planning, but also for attracting future partners, financiers, or strategic interest.

At this stage, Norsemont Mining Corp. (OTC: NRRSF) is not declaring an endgame. The objective is to methodically move the project closer to a point where its size, quality, and economics can be properly assessed under modern standards.

Inside the Choquelimpie Project

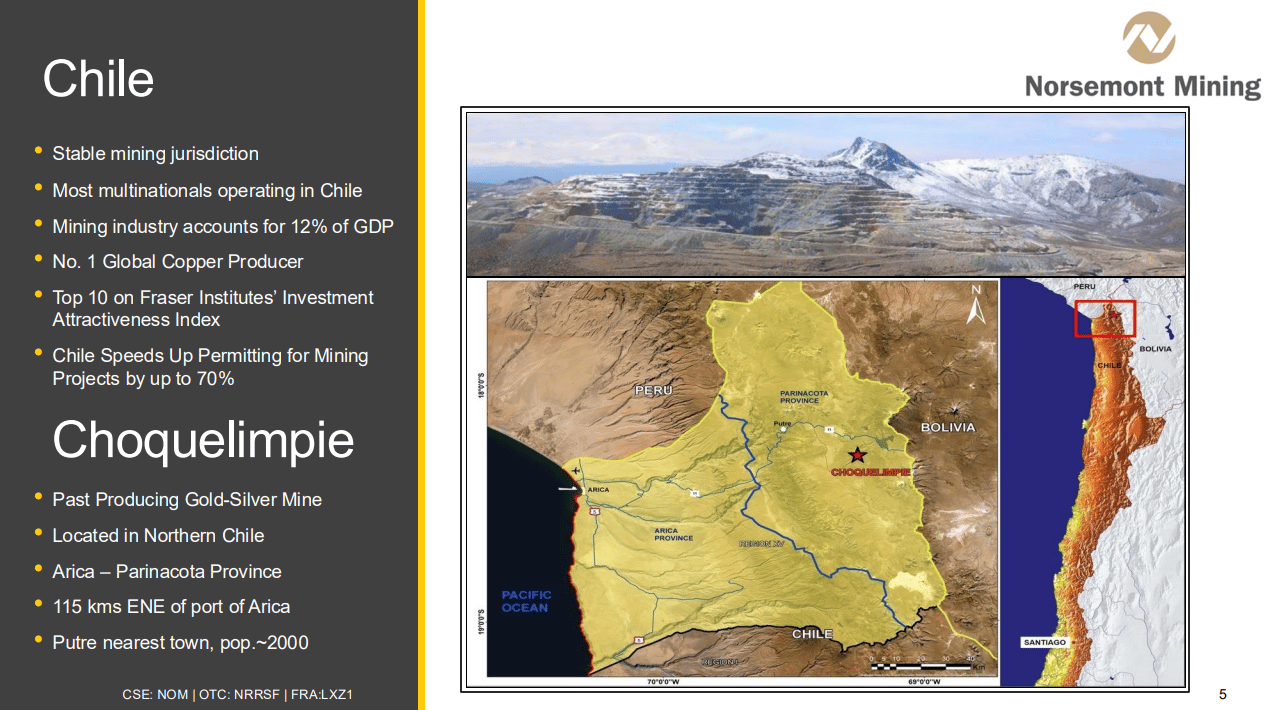

The Choquelimpie Gold–Silver–Copper Project is not a blank piece of ground waiting to be figured out. It is a brownfield system with decades of technical work already completed, which fundamentally changes how the project is evaluated today.

Choquelimpie has a long operating history that includes underground and open-pit mining, processing facilities, and extensive drilling. More than one thousand seven hundred drill holes have been completed across the property, totaling well over one hundred forty thousand meters of historical drilling. That volume of data provides a detailed picture of the mineralized system and allows the current team to work from an established geological foundation rather than starting from scratch.

The mineralization at Choquelimpie occurs in multiple zones and hosts both oxide and sulfide material. This matters because it opens different development paths. Near-surface oxide material has historically been processed using heap leaching, while deeper sulfide material introduces longer-term optionality through milling and flotation. Past metallurgical work demonstrated strong recoveries from both styles of mineralization, supporting the idea that the system is technically workable across multiple horizons.

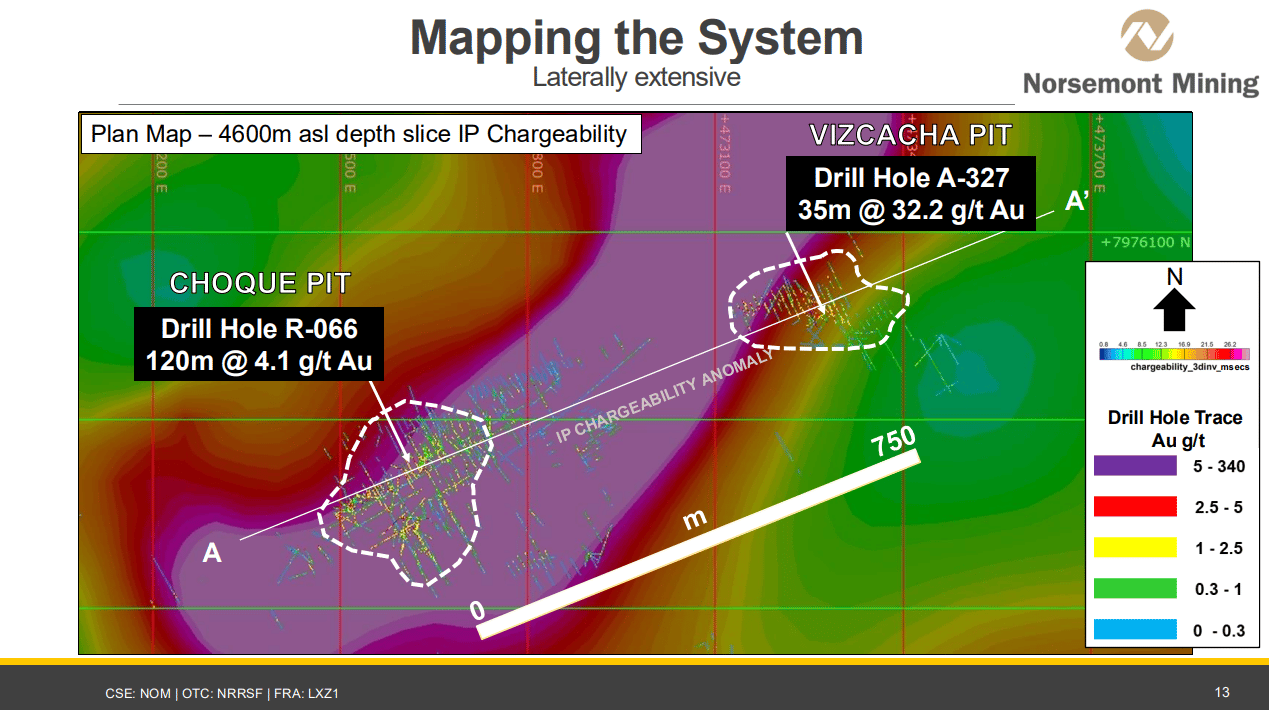

One of the more notable aspects of Choquelimpie is its scale. Mineralization is not confined to a single narrow structure. Instead, it occurs across a broad area with multiple zones that remain open laterally and at depth. Several targets have seen limited or no modern drilling, leaving room for expansion beyond what was historically defined.

Infrastructure is another differentiator. The project is accessible by road, sits at elevation suitable for year-round operations, and benefits from proximity to power and regional mining services. Existing site infrastructure from prior operations reduces both time and capital required to advance future work programs.

Geologically, Choquelimpie sits within a well understood mineral belt that has supported large, long-life mines. The deposit style is consistent with systems that can grow through continued drilling as geological models improve and higher-resolution data is layered in.

What the company is doing now is not reinventing the project. The focus is on validating historical data under modern standards, tightening the geological model, and identifying where additional ounces can be added through targeted drilling. This approach lowers exploration risk while still preserving upside.

Choquelimpie is best described as a project that already has substance, data, and history, but has not yet been fully optimized using today’s tools, pricing environment, and development strategies. That combination is what makes the asset relevant at this stage of the gold cycle.

The Bottom Line

At a time when gold prices are sitting at all-time highs, the gap between early-stage exploration stories and advanced, de-risked projects has never been more important. Norsemont sits firmly in the latter category. This is not a story built on conceptual upside or blue-sky exploration. It is built on a past-producing asset with scale, infrastructure, and a long history of technical work that can be modernized and advanced under today’s standards.

Choquelimpie already has many of the attributes investors typically look for when evaluating development-stage gold projects. It is located in a proven mining jurisdiction, benefits from established access and infrastructure, and hosts both oxide and sulfide mineralization that allows for multiple potential development paths. Those features are not theoretical. They are already present and documented, which meaningfully lowers the execution risk compared to projects starting from scratch.

What makes the story particularly relevant in the current environment is timing. High gold prices change the economics of advanced projects far more than they do early-stage discoveries. Projects with existing data, historical production, and defined mineralization become increasingly strategic as the industry looks for assets that can be advanced rather than discovered. Choquelimpie fits squarely into that category.

Disclosure of Compensation

“The Influencer” and its officers, directors, owners, managers, affiliates, and control persons (collectively referred to as the “Publisher”) have been compensated two thousand U.S. dollars ($500 USD) by a third party to publish favorable information (the “Information”) about Norsemont Mining Corp. (OTC: NRRSF).

The Information shared by the Publisher is an advertisement.

Because the Publisher has received compensation to distribute this Information, securities laws including Section 10(b) of the Securities Exchange Act of 1934, Rule 10b 5, and Section 17(b) of the Securities Act of 1933 require disclosure of the nature and amount of such compensation.

The Paying Party and its affiliates may buy or sell securities of the Issuer before, during, or after the publication of this Information. This may result in profits due to price fluctuations influenced by the dissemination of this content.

Forward-Looking Statements

Certain information provided in this communication may contain “forward-looking statements,” which include “future-oriented financial information” and “financial outlook” under applicable securities laws. These statements are based on management’s current beliefs and expectations regarding business operations, financial performance, strategic plans, and market conditions.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that could cause actual results to differ materially from projections. Investors should not place undue reliance on these statements. Factors beyond the Company’s control may affect outcomes.

The Publisher does not undertake any obligation to update or revise forward-looking statements unless required by applicable securities laws. Readers are strongly advised to perform their own due diligence and consult a licensed financial advisor before making investment decisions.

Disclaimer for BeanWealth

BeanWealth is a publisher of financial education and information. We are not an investment advisor and do not provide personalized financial advice or recommendations. All content is for educational and informational purposes only.

Information is provided “as is,” without warranty of any kind. BeanWealth makes no representations or guarantees regarding accuracy, completeness, or timeliness. Opinions expressed are those of the author and do not necessarily reflect the views of BeanWealth, its partners, or affiliates.

Investors should conduct independent due diligence before making any investment decisions. None of the information provided constitutes a solicitation to buy or sell any securities.

BeanWealth, its employees, and affiliates may hold positions (long or short) in the securities mentioned, and these positions may change without notice.

Forward-looking statements, estimates, or forecasts are inherently uncertain and based on assumptions that may not occur. BeanWealth assumes no obligation to update or correct information after the publication date and disclaims liability for any loss or damage arising from its use.

Unauthorized reproduction or distribution of this content is strictly prohibited and may result in legal action.